- Emeren’s Q4/2022 revenues fell below guided range due to project delays in the US and Italy

- Annual revenues for 2022 went up 2% to $81.4 million thanks mainly to Europe business

- Increased its total project pipeline to targeted 3 GW in 2022, up from 2.1 GW in the previous year

- Plans to take advantage of higher solar PPA prices and supportive regulatory environment and strengthen its IPP business

Solar power developer Emeren, previously ReneSola, exited 2022 having increased its annual revenues by 2% to $81.4 million and increasing its total project pipeline to 3 GW from 2.1 GW at the end of 2021, which in 2023 it aims to grow to 4 GW. Roth Capital resumed, “Emery delivered a mixed Q4 and a healthy 2023 guide. Management is steadily delivering on its growth outlook and gave an outlook for MW monetization in 2023 and 2024 that exceeded expectations.”

Maximum revenues came from Europe that accounted for 57% of the total, followed by 25% share of China, and 17% share of North America.

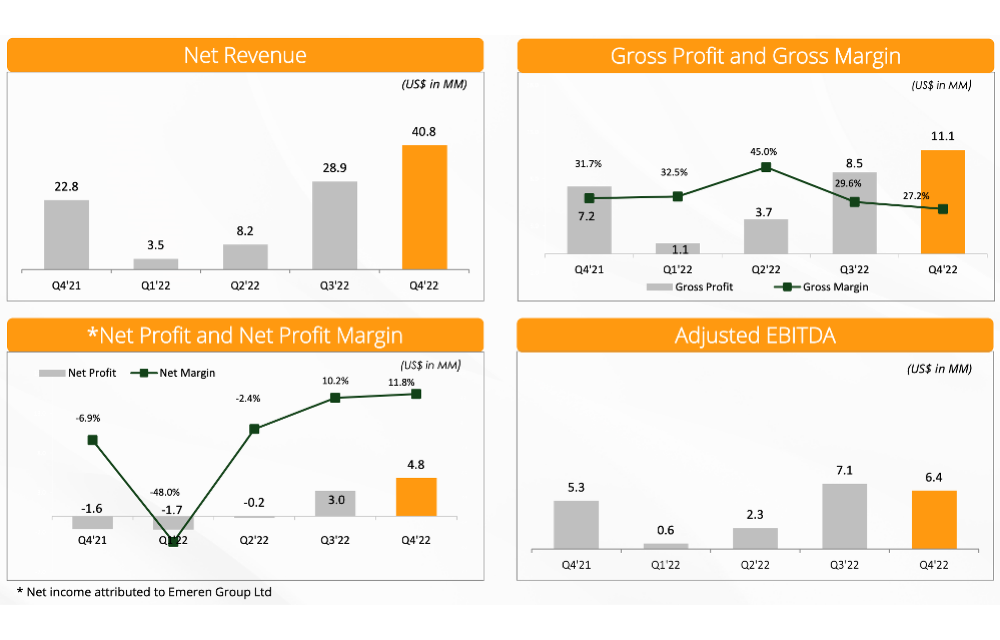

In Q4/2022, the revenues increased 41% QoQ and 79% YoY to $40.8 million which was below the guided range due to project delays in the US and Italy. Increase in revenues was attributed to consistent growth of project development business in countries as Poland, Germany, China and the US. Gross profit was $11.1 million, up from $7.2 million a year back.

In the reporting quarter, it achieved net profit of $4.8 million, up from -$1.6 million net loss in Q4/2021.

In 2023, it aims to monetize close to 400 MW to 450 MW, increasing the annual target to a minimum of 500 MW to 600 MW beyond 2023 thanks to its mid-to-late stage pipeline of 3 GW in 2022 which is mostly spread in Europe, the US and China, in that order. It came to the company when ReneSola acquired Emeren Limited in October 2022 (see ReneSola Takes Over UK Solar Projects Partner).

Emeren has also grown its storage pipeline to over 1.5 GW in the 3 geographies at the end of last year. In China, it has started developing commercial scale storage facilities. “Storage, in our view, could also serve as a source of upside,” Roth Capital said.

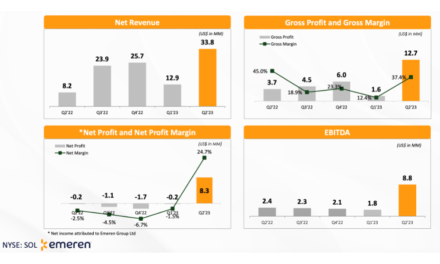

Management guides for its H1/2023 revenues to fall within the range of $70 million to $75 million, with gross margin between 24% to 27%. For full year 2023, the forecast is for revenues within $140 million and $160 million, and gross margin to hover around 30%. Net income for the entire year is pegged at $17 million to $21 million.

The company is building independent power producer (IPP) projects and is open to merger and acquisition opportunities across Europe ‘to take advantage of the higher solar PPA prices and the favorable regulatory environment’. Currently, its IPP projects that it owns and operates stand at a cumulative 252 MW, and it plans to build a total of 100 MW IPP assets in Europe by the end of 2023.