- Emeren’s Q4/2023 and FY2023 financial results were marred by project delays among other reasons

- The management blames rising interest rates, regulatory uncertainty and other issues for net loss reported

- Its 2024 guidance is more optimistic, however, as it expects demand for solar to continue with stronger government support

US and Europe-focused solar power developer Emeren Group Ltd exited 2023 with a missed guidance and net loss for which it has blamed rising interest rates and project delays for a number of reasons, including regulatory uncertainty in the 2 markets.

According to the management, “Our projects continued to face delays due to a mix of rising interest rates affecting financing terms, utility-scale project delays stemming from transmission capacity challenges, and regulatory uncertainty in the U.S. and Europe. These challenges underscore the need for adaptability in our project financing strategies, the importance of early engagement with transmission and utility stakeholders, and close monitoring of regulatory developments in the US and Europe.”

Financial results

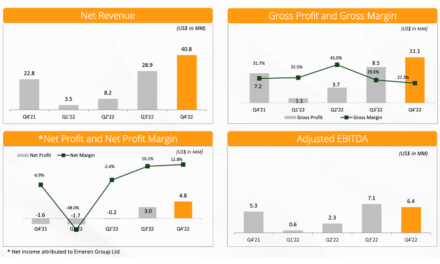

The company’s $104.7 million revenues last year improved by 71% annually with a gross margin of 22.2%. Gross profit went up by 52% year-on-year (YoY) to $23.3 million. Nonetheless, the management reports -$1.7 million in EBITDA compared to $6.7 million in the previous year.

Listed on the New York Stock Exchange (NYSE) as SOL, Emeren’s net loss during the year widened to -$9.3 million, a 100% increase over -$4.7 million in 2022.

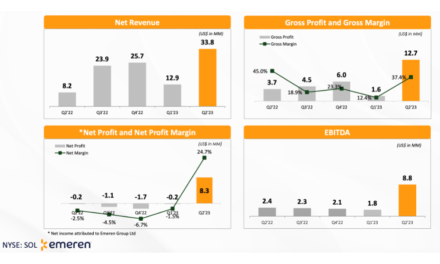

During Q4/2023, Emeren’s $44 million revenues were an annual increase of 71% and a sequential improvement of 215%. Nonetheless, its gross margin of 7.6% was lower than the guided range due to more EPC projects and delays in closings of development project sales in the US and Europe.

EBITDA was a negative -$5.5 million and net loss narrowed from -$9.4 million in Q3/2023 to -$8.1 million in Q4/2023. In Q4/2022, the net loss was -$1.7 million.

In a letter to its shareholders, Emeren management admitted to its last 2 years’ results being unsatisfactory, but said it is addressing the issues. The company said it is implementing strategic cost control initiatives including laying off staff, halting certain greenfield developments and focusing on advancing existing project portfolios.

Additionally, it is implementing Development Service Agreements (DSA) in the US and the European Union (EU) to recognize revenue and receive payments from early-stage projects in Italy. It is now expanding the DSA model to its other markets in the 2 regions. The management says the DSA model helps it to better manage its returns and risks throughout the development process.

Guidance

Looking into the future, the company pins its hopes for a better financial year in 2024 on the growing demand for clean energy, backed by positive government support and technology trends.

At the end of 2023, it had around 3.1 GW of solar project pipeline at an advanced stage. In 2024, it aims to monetize close to 400 MW to 450 MW.

Emeren’s independent storage project pipeline rose to some 5 GW at the end of 2023, with 4 to 8 hours durations in the planning, equal to 20 GWh to 40 GWh.

For 2024, it targets revenues of between $150 million and $160 million along with a gross margin touching 30% and a minimum of $26 million in net income.

To these annual targets, H1/2024 revenue contribution is forecast as between $50 million and $55 million, and gross margin of approximately 30%.

However, Philip Shen of ROTH MKM is skeptical about Emeren’s annual forecast. He says, “With the challenging 2023 performance, we expect management to have adequately built in conservatism into its 2024 outlook.” He adds, “We believe the initiative to implement Development Service Agreements (DSAs) in the US and EU could improve the company’s overall revenue/earnings quality over time. Additionally, FERC Order 2023 should help improve US volumes ahead. Execution ahead is critical, and we look for management to systematically improve ahead.”

Shen is referring to the US Federal Energy Regulatory Commission (FERC) expected to issue a new nationwide transmission planning rule to improve grid connection for renewable energy.