- First Solar’s 2021 shipments of 7.7 GW were at the lower end of its guidance due to module supply delays

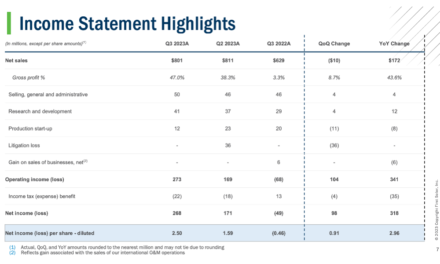

- Q4/2021 net sales of $907 million came in with shipments of 2.1 GW, also due to lengthy transit time

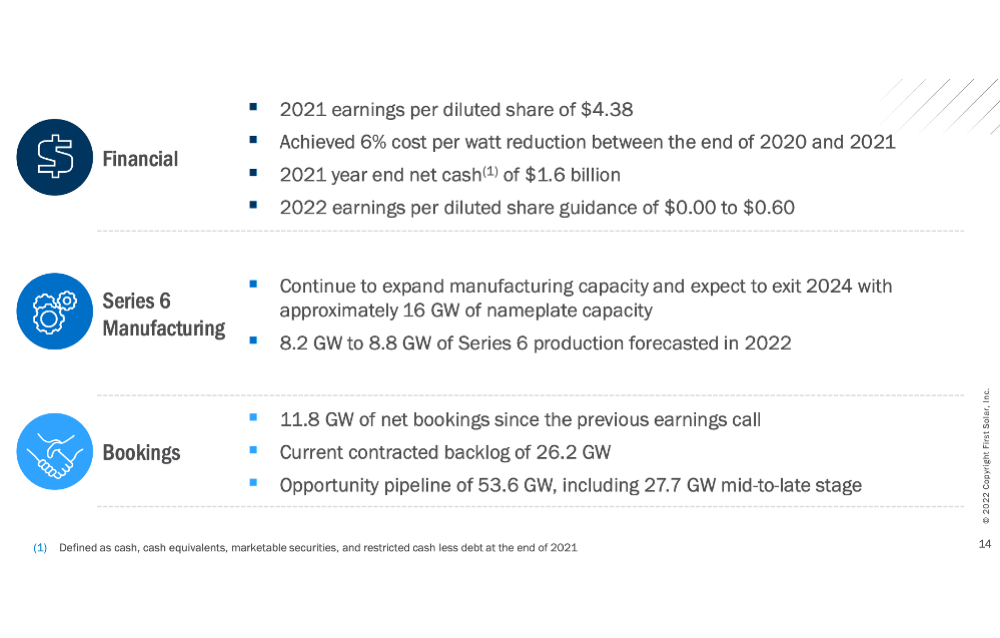

- Since the earnings call of Q3/2021 to date its net bookings add up to 11.8 GW; Registered 17.5 GW DC net bookings in 2021

- Plans to sell Japanese project development, and operations & maintenance platform

- It expects to ship 8.9 GW to 9.4 GW of modules in 2022 and guides for net sales between $2.4 billion to $2.6 billion

Module shipment delays due to constraints related to container availability led US based First Solar, Inc to report its full year 2021 shipments at the lower end of its guidance at 7.7 GW, with 1.2 GW of inventory on hand and 675 MW shipments in transit not recognized as revenue.

The worst hit it during Q4/2021 when the total transit time for transoceanic freight increased by a factor of weeks since Q3/2021, explained CEO Mark Widmar, reaching ‘levels nearly double historic norms’. Congestion at US ports and capacity limits with by road shipments played their role too. Due to this, it managed to ship 2.1 GW with net sales coming in as $907 million.

Management reported 2021 net sales of $2.9 billion at the lower end of its guidance range due to above factors. The gross margin stayed basically level year on year at 25%.

In addition, rising cost of aluminum, which the management said has increased by over 40% from the start to the end of 2021, has been a strong headwind against its module costs which it has partially offset by reducing its content for Series 6 Plus frames by 10% at its Malaysia and US fabs.

Bookings and manufacturing update

Among the positives, it managed to grow its net bookings in 2021 by 17.5 GW DC. Since the earnings call of Q3/2021 to date its net bookings add up to 11.8 GW, including 4.8 GW registered within 2022 so far.

Its Series 7 fab in Ohio is currently under construction and expected to commence initial production in H1/2023 and the India fab by the end of 2023 where First Solar will produce 570W monofacial panels. Once these fabs come online, it is ‘expected to reduce cost per watt and net sales freight costs $0.01 to $0.02 relative to Series 6’.

The thin-film module manufacturer is exploring options for further expansion which is likely to be within the US, India or elsewhere but for that it awaits clarity on domestic solar policies.

It aims to exit 2024 with close to 16 GW of nameplate manufacturing capacity and produce 8.2 GW to 8.8 GW of Series 6 panels in 2022.

Japan business

First Solar shared receiving an unsolicited offer of acquisition for its project development, and operations & maintenance platform in Japan and it is at an advanced stage of negotiations to sell the same.

Guidance

For 2022, First Solar expects to ship 8.9 GW to 9.4 GW of modules. It has guided for its net sales between $2.4 billion to $2.6 billion with a gross profit in the range of $155 million to $215 million and a gross margin up to 8.3%. Operating expenses will be within the range of $365 million and $380 million, while operating income is guided as $55 million to $150 million.

Management expects to incur capital expenditures of $850 million to $1.1 billion during this year.

Jeffrey Osborne, analyst at investment bank Cowen commented, “We continue to view 2022 as a transition year for First Solar given the U.S. & India buildouts, new contract structures, and new technology via the Series 7 introduction.” Adding, “we remain constructive on strong demand supported by 11.8 GW of net booking since the November earnings call, which provides visibility beyond a sold out 2022. New capacity ramping in 2023 offers reduced freight risk given local demand.”