Backsheets are key process consumables in solar module manufacturing that influence both cost and quality of a solar panel. In regard to long-term protection of the panel, backsheets have two main functions – electrical insulation and to block moisture ingression. In the end, backsheets are a crucial part of the outer shell to protect the module components from environmental degradation.

That’s why my TaiyangNews colleague Shravan K. Chunduri and me have delved into this field and published a market survey on backsheets for solar modules, which provides an overview on the technology and contains specs of 43 products from leading suppliers – Cybrid, Jolywood, Coveme, Hangzhou First, Krempel, Filmcutter, Feron and DSM (formerly Sunshine).

So many changes

A lot of changes have been happening in the backsheet segment over the last decade. Once a segment almost entirely dominated by Tedlar-based products, a supply shortage offered PVDF/Kynar as well as pure PET solutions the opportunity to enter the market. Then we have seen films getting thinner, less layers – and coatings gaining shares, both fluoro and non-fluoropolymer based.

Made in China

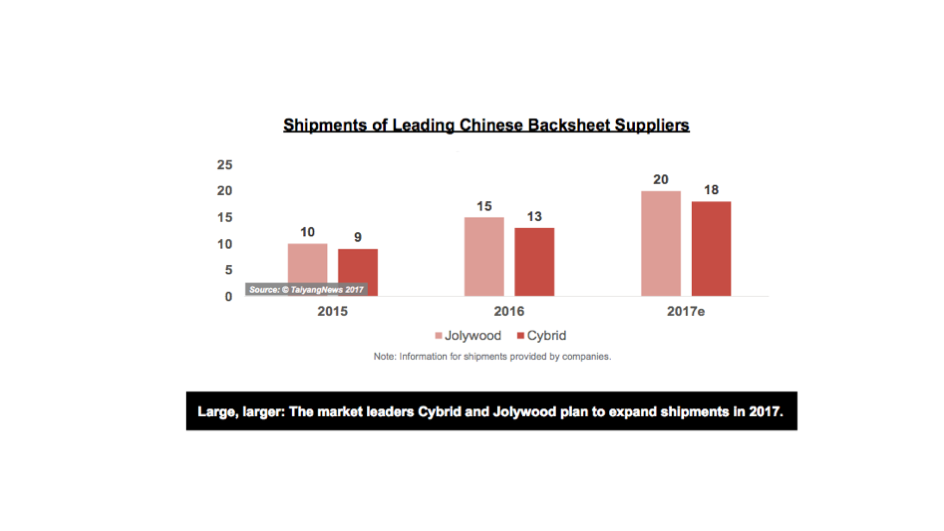

We have also seen a segment dominated by western players turning into a field strongly dominated by companies from China. Jolywood and Cybrid have shipped together about 28 GW in 2016 and plan to expand sales to around 38 GW in 2017, which would be around half of global solar demand this year.

New players

At the same time, we are seeing consolidation and new players entering the fray – after global market leader for anti-reflection module coatings DSM from Holland took over backsheet maker Sunshine New Materials Technology in China, it is assumed to push hard for winning market shares. Afga, a leading supplier of polyester for the core layer, is just launching a full backheeet product (though using Cybrid’s fluorine polymer skin layer).

Huge technology choice

In fact, the offer on backsheets technologies is probably wider than ever. Today, module makers can select from the classical TPT composition to pure polyester-based solutions and many different coating variations. There is basically almost any product available a module manufacturer’s heart is looking for – and in various quality levels.

Performance of a product is one thing – and the leading suppliers are obviously having on hand test results that show their backsheets are superior. But as is well known from the module side of the equation, it is cost and price that’s driving sales. And that won’t change – with the solar module being a commodity that continues to be under strong price pressure.

Consolidation

For that reason, it is very likely that we see further consolidation in the sector – with suppliers not willing or able to operate on thin margins getting out; they might also sell their solar product segments, in case they are not just a simple converter but own some product innovation or differentiation, as was the case with Sunshine.

Latest developments

We are also seeing further advancements in the backsheet segment: Hangzhou First, for example, has introduced a transparent backsheet, which is currently being tested by customers. There will be more products suitable for 1,500 V, according to the latest IEC 61730 standard. Coveme and Cybrid, for example, are working with highly reflective materials, and their existing product ranges can already be ordered with high reflectivity. Cybrid is developing a solution to replace the core PET film with a polymer “alloy” for both cost and quality reasons.

Challenges?

There are also potential challenges from outside the backsheet segment as several module makers would like to see more glass-glass solutions, but despite quite some marketing efforts this hasn’t been successful so far. So at least from the outer side there is not so much changes to be expected in the short run.

The TaiyangNews Market Survey on Backsheets for Solar Modules 2017 can be downloaded free of charge here.