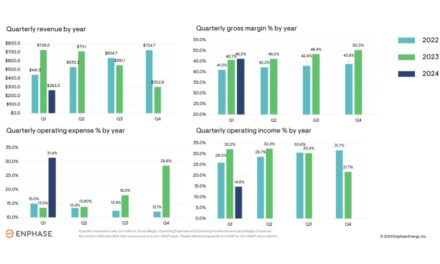

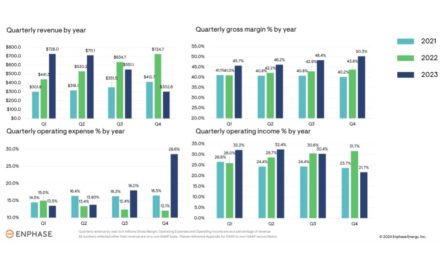

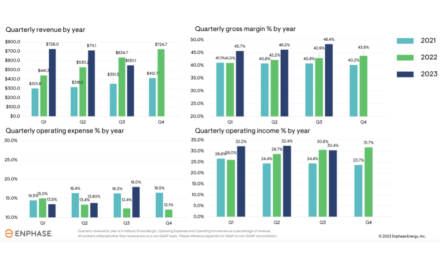

- Enphase Energy’s Q2/2022 revenues increased 20% on quarterly basis to $530.2 million

- Maximum revenues came from the US and Europe markets; for the latter, it was mainly the Netherlands and Germany

- It shipped 132.4 MWh IQ batteries during the quarter with major shipments going to the US, Germany and Belgium

- Enphase has now guided for Q3/2022 revenues within $590 million and $630 million

US based solar microinverter and storage systems supplier Enphase Energy, Inc reported another healthy quarter in Q2/2022 with 66% annual growth in the US and 89% in Europe contributing to total revenues of $530.19 million, while GAAP net income swelled to $76.97 million.

GAAP operating expenses increased to $124.96 million from $115.15 million in Q1/2022, and $68.4 million in Q2/2021 (see Enphase Energy’s Q1/2022 Financial Results).

In Europe, the growth regions were mainly the Netherlands and Germany. “Homeowners want self-consumption as the region not only faces rising energy prices but also a growing demand for home electrification driven by EVs and natural gas shortages. We expect to introduce IQ Batteries in more European countries during the second half of 2022,” said Enphase President and CEO President and CEO Badri Kothandaraman.

In Latin America, revenues increased 22% QoQ and 61% YoY basis.

In terms of product portfolio, the management said 20% sequential revenue growth came from 18% increase in microinverter shipments and 10% rise in IQ battery shipments during the reporting quarter. A total of 37% microinverter shipments comprised the grid forming IQ8 series that can provide Sunlight Backup during an outage, even without a battery.

In total, Enphase shipped 132.4 MWh IQ batteries, up from 120.4 MWh in the previous quarter with shipments going to the US, Germany and Belgium.

Philip Shen of Roth Capital Partners commented, “We see potential for the company to continue to gain share not only in Europe, but also in the US despite its leading market share. The company is doing this while maintaining price. We believe margin expansion is largely being driven by the mix shift to IQ8, which has a 15% premium vs. IQ7.”

For Europe, the management sees channel inventory below normal levels. The CEO said he expects Enphase to grow revenues more than 40% in Q3/2022 compared to Q2/2022 on the continent.

Kothandaraman added though that the company continues to face global logistics challenges as its lead times for batteries is still around 14 weeks to 16 weeks. It remains on track to add an additional cell pack supplier for 3rd generation battery, early 2023.

Currently, its quarterly capacity across all contract manufacturing facilities is around 5 million microinverters. The Romania fab is on schedule to become operational in Q1/2023, taking the aggregate quarterly production to 6 million (see North America PV News Snippets).

Going forward, Enphase has guided for its Q3/2022 revenues to be within the range of $590 million and $630 million, including shipments of 130 MWh to 145 MWh of Enphase IQ batteries.

It expects GAAP gross margin within 38.0% to 41.0%, and operating expenses between $137 million and $141 million.