- Tata Power holds 10% of the total Indian large scale operating solar project development, according to research from Mercom Capital

- With its organic growth in the segment, Adani is set to replace Tata for the top slot in 2017

- Indian companies also take largest share when it comes to project development pipelines - the leader is ReNew Power, followed by Adani

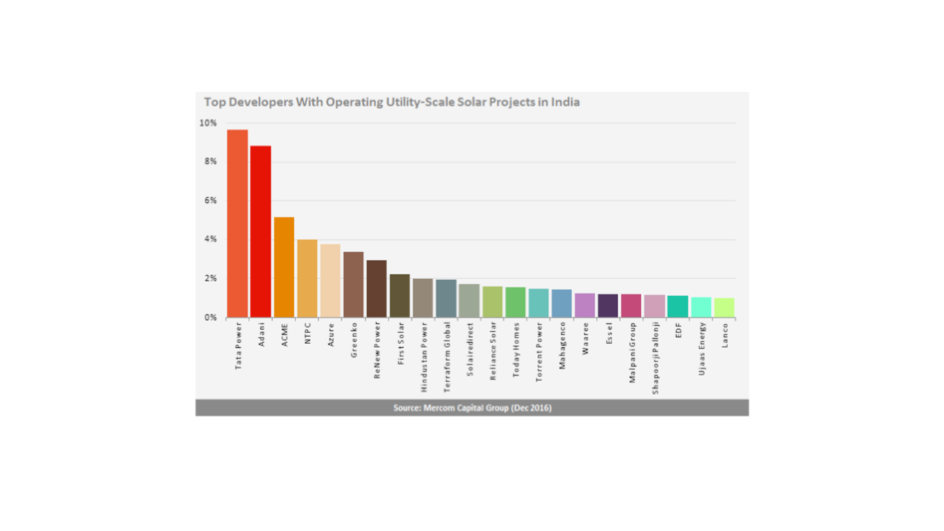

Large scale Indian solar development market is being led by Indian companies. As of December 2016, the top developer in the space is Tata Power with more than 850 MW of operating utility-scale solar projects or 10% of the market share in the space, according to Mercom Capital Group.

Today,there are around 200 developers with projects of at least 5 MW or more in operation in India. The leading 20 developers account for nearly 60% of all operating utility-scale projects in the country. Large conglomerates and private equity-backed pure-play developers are leading large-scale project development.

Mercom forecasts that today’s No.1, Tata Power, is set to be replaced this year by Adani, which currently holds over 800 MW of solar power assets, equal to a 9% total market share. Tata managed to take over the top post its acquisition of Welspun (see Tata Acquires Welspun Renewables). Another company that has grown in stature in this space through acquisitions is Greenko, which is now ranked No. 6 (see SunEdison Indian Assets Acquisition Complete).

More such M&A opportunities are likely to come about as the Indian market continues to grow while Adani (No. 2) and Azure (#5) being the companies that have grown organically, as per Mercom.

In the top 10 list of India’s solar developers, it is only First Solar (#8) and TerraForm Global (#10) that hold the forte for international developers. Indian companies lead all the way when it comes to operating utility-scale solar projects in the country, especially large conglomerates and private equity backed pure-play developers. This is in stark contrast with the dominance of international players in the solar inverter manufacturing segment (see ABB Leads Indian PV Inverter Market).

When it comes to the project development pipeline, it is ReNew Power, again an Indian company, that owns more than 1.3 GW or 10% of the market, followed by Adani with over 1.2 GW or 9% market share. In India, there are around 110 project developers with pipelines of 5 MW or more, according to Mercom. The top 20 developers, however, own 75% of the entire utility-scale solar project pipeline.