- First Solar’s net sales for the year 2020 declined to $2.7 billion, down from $3.06 billion in 2019, but its net income surged to $398 million

- Having produced 6.1 GW of total solar module capacity in 2020, it shipped 5.5 GW last year and by 2021-end it will increase fleet-wide nameplate capacity to 9.4 GW

- Management said it is evaluating domestic and international policies to further diversify and expand its manufacturing capacity

- The company has guided for net sales of $2.85 billion to $3.0 billion in 2021

Having faced ‘continued intense competition’ across the crystalline PV supply chain and ‘unforeseen challenges’ related to the pandemic, US based solar module manufacturer First Solar, Inc. reported net sales of $2.7 billion in 2020, having declined from $3.06 billion it reported in 2019 (see First Solar Exits 2019 With $114.9 Million Net Loss).

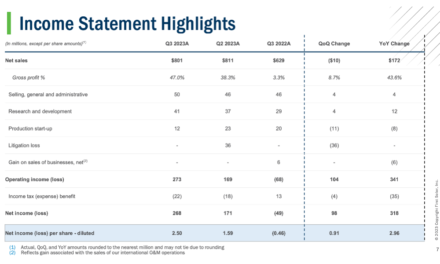

However, the company returned to profitability in 2020 with $398 million net income. During Q4/2020, its net sales decreased $0.3 billion on sequential basis, for which the reason attributed was a result of higher international project sales in Q3/2020, partially offset by increased module sales in Q4/2020 (see First Solar’s Net Income Surged In Q3/2020).

Manufacturing update

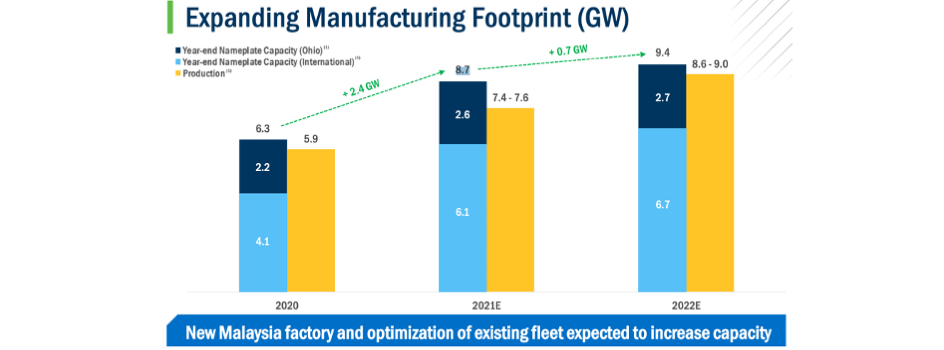

First Solar produced 6.1 GW of total solar module capacity in 2020, including 5.9 GW of Series 6 with maximum power output of 445W. It shipped 5.5 GW capacity in 2020 and contracted 700 MW.

By the end of 2021, the US headquartered manufacturer will aim to increase its fleet-wide nameplate capacity to 8.7 GW comprising 6.1 GW in its international fabs in Vietnam and Malaysia, and 2.6 GW in Ohio. By the end of 2022, it should end up at 9.4 GW nameplate capacity divided as 6.7 GW internationally and 2.7 GW in Ohio.

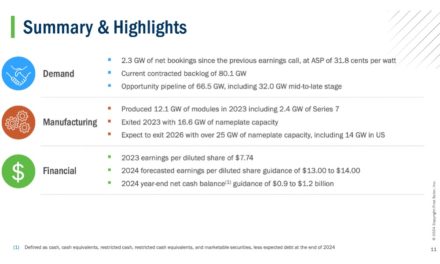

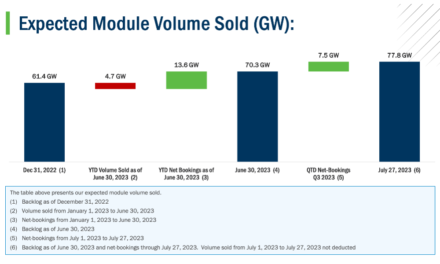

Management said the company is evaluating the potential for future capacity expansion to further diversify its manufacturing presence. CEO Mark Widmar shared the company is ‘evaluating domestic and international policies to ensure any such expansion as well-positioned’. First Solar booked 7.2 GW capacity to be delivered in 2021, 5.9 GW in 2022 and 2.3 GW across 2023 and 2024. Its current contracted backlog stands at 13.7 GW with an opportunity pipeline of 19.7 GW including 12.6 GW mid-to-late stage.

Philip Shen of Roth Capital Partners sees a positive for First Solar in the near term saying, “We expect momentum to accelerate further as the risk of WROs (Withhold Release Orders) against modules with Chinese sourced polysilicon may be put in place. Pricing appears to be healthy with margin expansion expected. While the efficiency outlook remains challenged the momentum to buy American is material and we expect this to serve as a tailwind ahead.”

Guidance

In 2021, First Solar has guided for its shipments to be between 7.8 GW and 8.0 GW, exceeding its production plan for the year which is in the range of 7.4 GW to 7.6 GW. During this year, the management expects to report net sales of $2.85 billion to $3.0 billion with gross profit of $710 million to $775 million and operating expenses being $285 million to $300 million. Operating income is guided as between $545 million and $640 million.

First Solar aims to exit 2021 with a net cash balance of $1.8 billion to $1.9 billion.

In a separate statement released, First Solar announced contracting an order to supply up to 2.4 GW DC of its high performance Series 6 modules to Intersect Power calling it ‘one of the largest aggregate orders for the modules to date’.