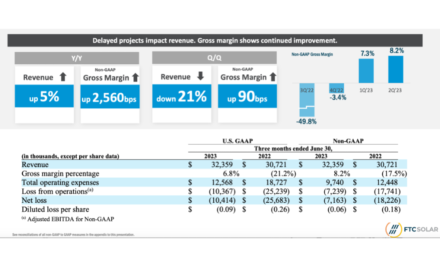

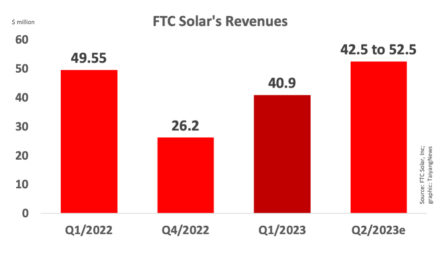

- Q2/2022 revenues for FTC Solar were in line with guidance as net loss was reported as -$25.7 million

- Management is now seeing an uptick in customer project discussions as developers and EPC customers work to ensure module supply for 2022 and 2023

- Q3/2022 guidance still represent module supply constraints, but Q4/2022 business expected to improve

US based solar tracker supplier FTC Solar has reported its Q2/2022 revenues of $30.7 million to have dropped 38% QoQ and 39% YoY, pulled down by lower demand in the US, module availability constraints and regulatory environment. The results were somewhat offset by higher ASP.

Revenues reported are at the lower end of its guidance of $30 million to $35 million which back then the management said reflects module availability concerns for US developers. It had also withdrawn the annual revenue guidance for 2022 citing the same reason (see FTC Solar Declares Q1/2022 Financial Results).

GAAP gross loss was $6.5 million or 21.2% of revenues, while net loss was -$25.7 million.

“Following the President’s executive order on clean energy in June, we have observed a significant uptick in customer project discussions. Developer and EPC customers are eagerly working to secure sufficient module supply for both delayed 2022 projects as well as a strong funnel of 2023 projects,” said FTC Solar President and CEO Sean Hunkler. “Based on these and other discussions, we believe that successfully navigating UFLPA import restrictions on solar modules remains the last hurdle for the industry to overcome to ensure a very strong recovery in 2023.”

As on August 8, 2022, FTC’s total contracted and awarded orders added up to worth $774 million with expected delivery dates in 2022 and beyond, and comprises new orders worth $141 million since its last update on May 9, 2022. It includes a new project in Thailand.

“The company continued to make meaningful headway diversifying its revenue, having announced its first project award in Thailand. This is in addition to the 3 projects highlighted last quarter in Kenya, South Africa, and Malaysia. Importantly, we believe that all these projects are structured in USD which should reduce any FX related headwinds,” noted Cowen analyst Jeffrey Osborne.

Guidance

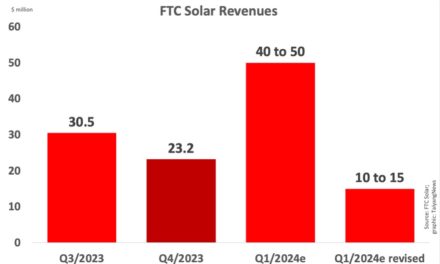

Going forward, the management does not expect any miracles as Q3/2022 revenues ($16.5 million and $19.0 million) are still likely to represent the ‘low-water mark’ reflecting a continuation of largely prior-ended module supply related customer project delays, ahead of international projects starting production in Q4/2022.

Due to lower revenues, it has guided for its non-GAAP gross margin for Q3 as between -50% to -20%.

FTC Solar managed to secure the lower end of its guidance in Q2/2022, but sees module supply constraints hampering its Q3/2022 guidance, which is expected to improve in Q4/2022. (Source: FTC Solar)

It expects to cover up in Q4/2022 when it guides for revenues between $75 million and $90 million as new project wins begin production. These projects, along with lower margin legacy projects achieving completion, is likely to push up non-GAAP gross margin to the range of 9% to 14%.

“While we are still looking for incremental clarity on how much module supply will be available to customers, we believe the ingredients are coming into place to set the industry up for a very strong year in 2023,” stated the management. “We believe FTC Solar is well-positioned to quickly respond to pent-up customer demand, benefit from the continued cost reduction efforts and resume our strong growth trajectory.”

The company recently joined hands with AUI Partners in the US, targeting distributed generation market for its proprietary Voyager+2P tracker (see FTC Targets Small Scale Solar Installations).