- Three companies win 250 MW each in 750 MW Rewa solar park tender

- Two winners are Indian developers, ACME and Mahindra; the third, Solenergi, is a developer from Sweden

- All three offered lowest bids for first year tariff of 2.97 INR ($0.0444) per kWh and below

- The tariff will continue to increase by 0.05 INR ($0.0007) per kWh for a period of 15 years and touch 3.30 INR ($0.0494) per kWh

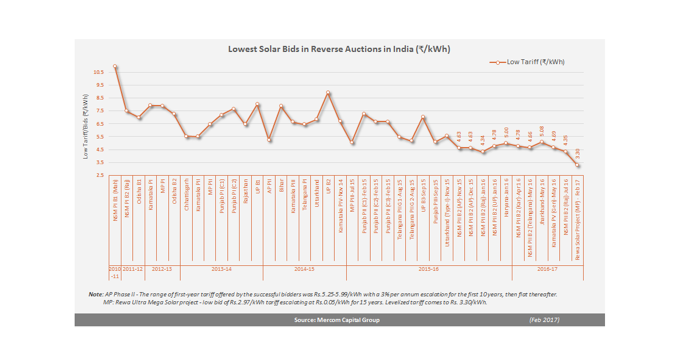

Solar power in India is getting considerably cheaper. The latest auction for a large-scale solar park lead to another record for the lowest tariff in India, around one year after the last record was broken.

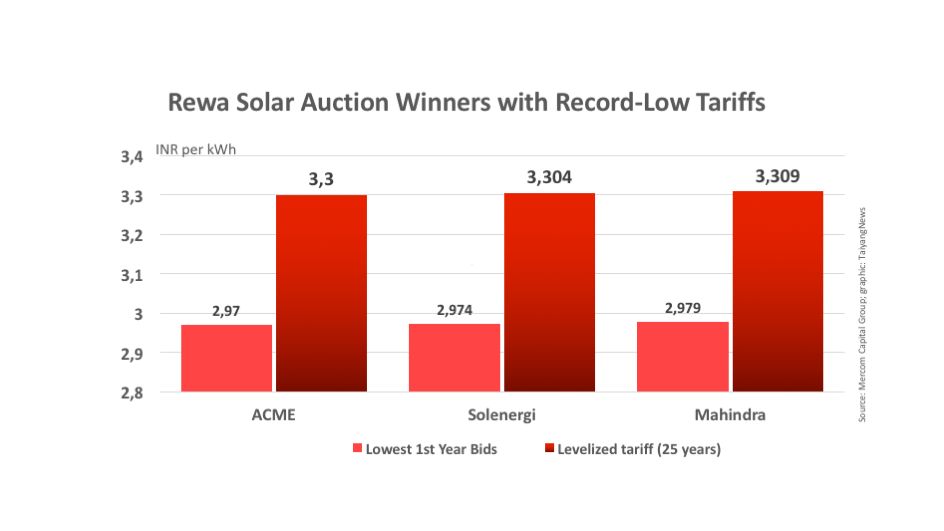

ACME Solar has won the entire 250 MW solar power capacity in Unit 2 of the Rewa Ultra Mega Solar Power project for the first year tariff of 2.97 INR ($0.0444) per kWh. This will increase by 0.05 INR ($0.0007) per kWh over a period of next 15 years to a levelized tariff of 3.30 INR ($0.0494) per kWh over 25 years, as per Mercom Capital Group. In January 2016, Finnish firm Fortum won 70 MW out of 420 MW auctioned by the National Thermal Power Corporation (NTPC) for a record low of 4.34 INR ($0.065) per kWh in Rajasthan.

In an official statement, ACME Group’s Founder and Chairman Manoj Kumar Upadhyay, said, “This is going to be the first time in the history that the tariff of electricity based out of Solar Power Plants is going to be at sub 3 level.”

It took a bit over a year until India’s previous lowest solar tariff of 4.34 INR from Fortum was broken again.(graphic credit: Mercom Capital Group)

Interestingly, ACME broke off with its French partner EDF Energies Nouvelles’ (EDF-EN) while standing by its decision to bid aggressively for solar power auctions in India, something the latter wasn’t comfortable with (see EDF & Acme Call Off Partnership). Apparently, the strategy continues to work for ACME as of now or so it seems.

The other companies that won 250 MW capacity each were Solenergi Power (Unit 3) with a low bid of 2.974 INR ($0.0444) per kWh and Mahindra Renewables (Unit 1) that won this capacity for 2.979 INR ($0.0445) per kWh.

The tender of 750 MW capacity was reportedly over-subscribed 10x, with a volume of 7,500 MW. The Solar Energy Corporation of India (SECI) had set the reserve price for this auction at 4.00 INR ($0.0602) per kWh, way back in November 2016 (see New Record-Low Benchmark PV Tariff In India). However, the fact that prices could go below 3.00 INR ($0.0448) per kWh was realized when financial bids were opened earlier this month (see Record Low Tariff Offers In 750 MW Rewa Tender).

Speaking to Mercom, an official of Madhya Pradesh Urja Vikas Nigam Limited (MPUVNL), explained, “We saw record low bids largely because of our progress made on the solar park infrastructure, unlike other solar parks where projects were tendered during initial stages of park development. We in Madhya Pradesh waited to create conducive infrastructure, and the results are here for everyone to see.” The state government has also extended state guarantee for this project (see 750 MW ‘Ultra-Mega’ Solar Project In India).

The lowest tariff in India, however, is still not the world’s lowest. The lowest recorded solar tariff offered in an auction worldwide was in Abu Dhabi last year, when Chinese module maker JinkoSolar and Marubeni Corporation from Japan were leading the race of developers bidding for a 350 MW solar power capacity. The two had offered a tariff of $0.0242 per kWh (see Abu Dhabi 350 MW Tender). The final winner has yet to be awarded in this tender.

While pointing out the unique characteristics of the Rewa 750 MW tender results, Raj Prabhu, CEO of Mercom, cautioned against comparing them to the rest of such reverse auctions in India. “The size and location of the projects, payment guarantees, deemed generation benefit, longer construction timeline, the recent solar module price crash, and yearly tariff escalation for 15 years – all make the low bids unique,’ he said. Adding, ” The fear is that media, government officials and analysts will hype up the low bids and other states will then start pressuring developers to match bids from the Rewa auction tariffs, which has happened in the past.”