- 5.7 GW overseas shipments made up Risen Energy’s total module shipments of 8.1 GW in 2021

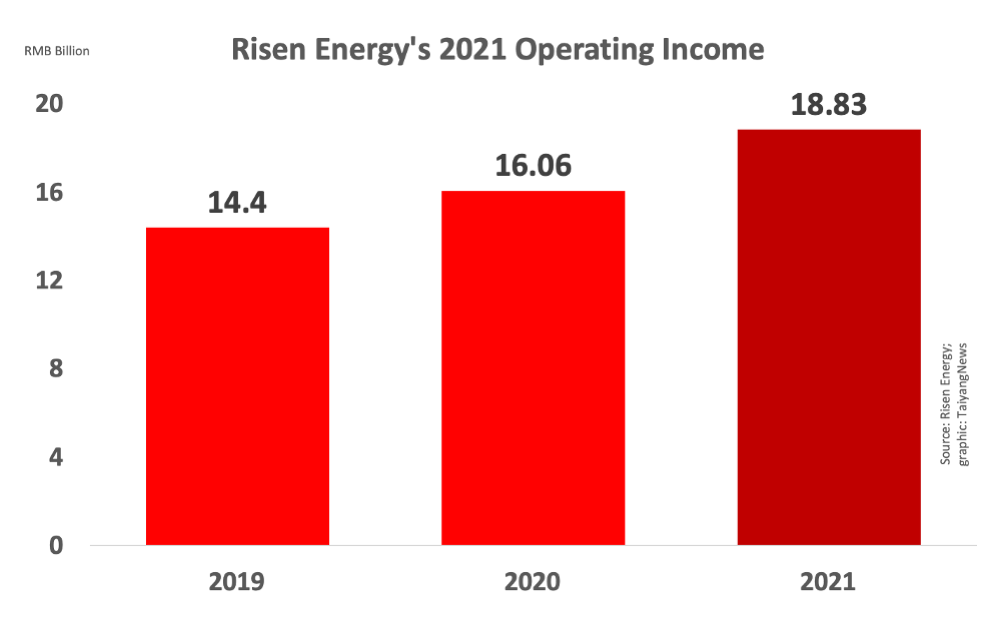

- 2021 operating income increased 17.2%

- Net loss during the reporting period was RMB -42 million, compared to RMB 165.34 million net profit in 2020

- The Chinese company exited 2021 with a cumulative annual module production capacity of 19.1 GW

- To deal with industry fluctuations, the management said Risen will focus on its module business, while increasing self-produced cell capacity

Chinese solar cell and module producer Risen Energy shipped 8.1 GW of modules in 2021, out of which 5.7 GW alone went overseas to markets as Brazil, Australia, Chile, Poland and Denmark.

While its 2021 operating income last increased 17.23% to RMB 18.83 billion annually, the company reported a net loss of RMB -42 million that came down 125.59% from RMB 165.34 million net profit it declared in 2020.

Of the total operating income, Risen’s solar cells and modules business division accounted for 70.15% share with RMB 13.21 billion share. The EPC and solar power plant business segment was responsible for RMB 1.176 billion or 6.25%, and its EVA segment added another RMB 1.644 billion or 8.73% to the total.

To overcome with the adverse impact of industry chain fluctuations, Risen said it will actively focus on its main business of solar modules, increasing its production capacity and sales while increasing the share of self-produced cells. It will also concentrate on developing new products to meet market demand.

Regarding its production capacity, Risen said at the end of last year, its cumulative annual module capacity was 19.1 GW, with the majority of it located within China in Zhejiang’s Ningbo and Yiwu, Jiangsu’s Jintan, and Anhui’s Chuzhou.

The management said Risen’s operating costs and administrative expenses increased on annual basis while it dealt with exchange rate fluctuations of currencies as US and Australian dollar.

In February 2022, Risen said it will invest in 15 GW of N-type ultra-low-carbon high efficiency HJT cell and another 15 GW HJT module production fab in Ningbo, China (see China PV News Snippets).