- Shoals Technologies’s Q1/2021 revenues were an annual increase of 12% with $45.6 million posted

- System solutions business represented 73% of total revenues as it soared 46% YoY thanks mainly to its combine-as-you-go system

- Backlog and awarded orders of $180.6 million at the end of Q1/2021 grew 42% YoY and 15% QoQ

- Management has reiterated its full year revenues and adjusted EBITDA guidance

US based electrical balance of system (BOS) solutions provider for solar, battery storage and electric vehicle (EV) charging infrastructure, Shoals Technologies Group, Inc. has posted ‘record’ 1st quarter revenues of $45.6 million in Q1/2021, reflecting an annual increase of 12%.

It was led by the company’s system solutions business contributing 46% YOY increase with $33.4 million and accounting for 73% of total revenues, which was partially offset by a decline in components revenues. Management said the growth in system solutions shows strong demand for its combine-as-you-go system, while the decline in components revenues was expected and reflected ‘an expected change’ in the timing of orders from some customers as well as conversion of other customers from buyers of components to buyers of system solutions.

Adjusted EBITDA went up 17% annually to $14.1 million. Higher revenues helped increase company’s gross profit by 32% annually to $18.8 million, and was also due to some other factors as ‘purchasing efficiencies from increased volumes, improved material planning which reduced logistics costs, enhancements to product design that lowered manufacturing costs, and other manufacturing efficiencies resulting from higher production volume’. Gross margin went up to 41.2% from 34.8% in the previous year.

It did take a hit with a net loss of $-8.3 million, compared to net income of $9.3 million in Q1/2020, due to an early repayment of a portion of its term loan facility.

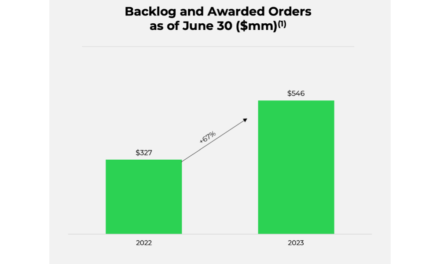

At the end of March 2021, its backlog and awarded orders were a total of $180.6 million mainly due to high demand in the US, growing 42% YoY and 15% QoQ.

For 2021, Shoals has reiterated its guidance for its revenues to fall in the range of $230 million to $240 million, adjusted EBITDA within $75 million to $80 million, and adjusted net income as $47 million to $51 million (see Shoals Technologies Grew Annual Revenues In 2020 By 21%). It also expects close to 45% of annual revenues, to be recorded in H1/2021, using the midpoint of guidance.

Management shared that after it launched its initial public offering (IPO) in January 2021, it had converted 4 major EPCs and developers as its customers, a number that at the end of Q1/2021 had grown to 8 companies that now use its big lead assembly (BLA) solution and a ‘dozen’ new customers that it plans to convert too.

“We shipped preproduction samples of our first wire management products to a customer in April, ahead of schedule, and we expect 1st commercial sales in the 4th quarter as well. We now have our sales team in place in Europe and expect to see orders from that region this year. Lastly, we have made significant progress on our new products for EV charging and are planning to accelerate the launch of our 1st product from 2022 to the 2nd half of 2021,” added company CEO Jason Whitaker.

According to Jeffrey Osborne of Cowen, “We found commentary around a 50% y/y quoting activity and a 25% y/y increase in project size encouraging given the stronger economies of scale translates to higher margins for Shoals. Shoals also demonstrated faster customer conversion as within three months from their IPO they converted 4 additional major EPC prospects to customers. This is compared to 4 EPC customers in total prior to the IPO.”