- Shoals Technologies grew its annual revenues in Q2/2023 by 62% with high sales volumes

- System Solutions business represented 86% of the company’s revenues in the quarter, having grown 80% YoY

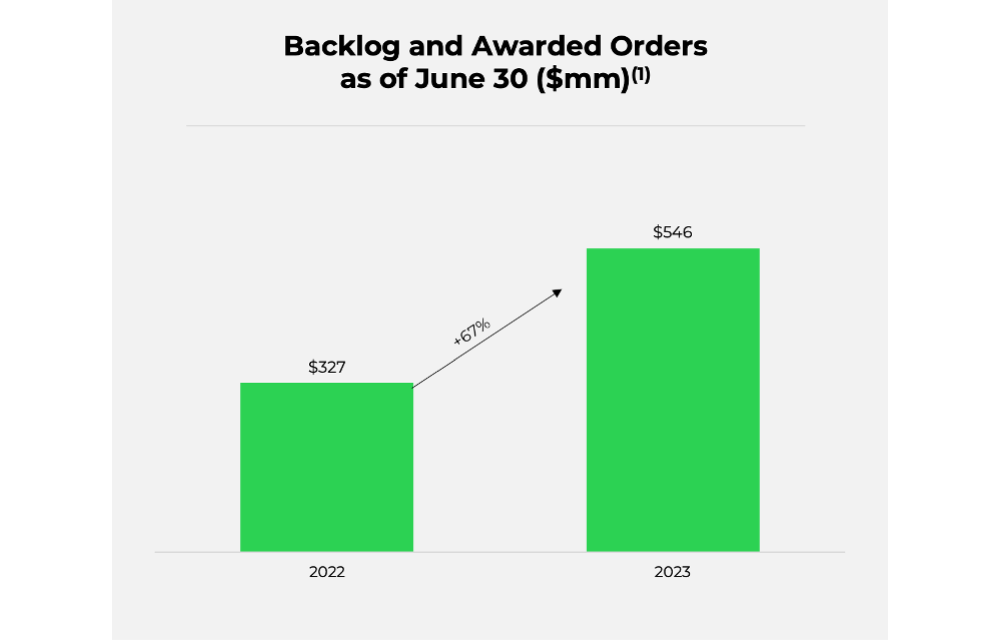

- Overall backlog and awarded orders till the end of June 2023 added up to $546.1 million

US based electrical balance of systems (EBOS) solutions firm Shoals Technologies Group reported healthy financial results in Q2/2023 with 62% annual increase in revenues of $119.2 million. The company attributed the improvement to higher sales volumes due to increased demand for its solar EBOS and combine-as-you-go system solutions.

Management said System Solutions contributed 80% more revenue compared to the previous year, representing 86% of overall revenues in the reporting quarter.

Since combine-as-you-go System Solutions products carry higher margins than its other products and since these brought in a higher portion of overall revenue, Shoals said gross profit as a percentage of revenue improved to 42.4%, compared to 38.9% in Q2/2022. Adjusted EBITDA increased 96% YoY to $38.7 million (see Shoals Technologies’ Q2/2022 Revenues Up 23% YoY).

Backlog and awarded orders

The 10 GW master supply agreement with renewable energy projects installer Blattner Company in June this year pushed up the backlog and awarded orders for Shoals by 67% annually to $546.1 million at the end of June 2023. Blattner will procure Big Lead Assembly (BLA) and systems solutions from Shoals over the next 2 years. Shoals continues to see demand for its products as Q2 quotes were up 71% YoY.

“Demand for our combine-as-you-go solution remained strong, with one new customer converting to our system during the quarter, bringing our total number of Big Lead Assembly (BLA) customers to 43,” said Shoals’ President Jeff Tolnar.

New products

Just before the earnings release, Shoals announced commercial availability and successful field deployments of its patent– pending Snapshot I-V solar PV health monitoring solutions for solar asset management. It plans to start commercial supply with Snapshot I-V Wireless Meter and Snapshot I-V Wireless Gateway from this family.

On the company’s Q2 earnings results call, management said it expects Snapshot to start generating revenue in H2/2023. The commercial launch of the High Capacity Plug-n-Play Wire Harness remains on track to generate revenues in Q4/2023.

Impressed with the results, ROTH MKM analyst Philip Shen said, “Looking ahead, we see a number of catalysts including sustained strength in bookings, more announcements with EPCs such as Blattner on multiyear deals, international and e-mobility wins, and wallet share expansion with the new products such as Snapshot I-V.”

The company, headed by the new CEO Brandon Moss, has reiterated its annual guidance of $480 million to $510 million annual revenues in 2023, and adjusted EBITDA of $145 million to $160 million, that it improved in Q1/2023 (see Growing PV Demand Boosts Shoals’ Business In Q1).