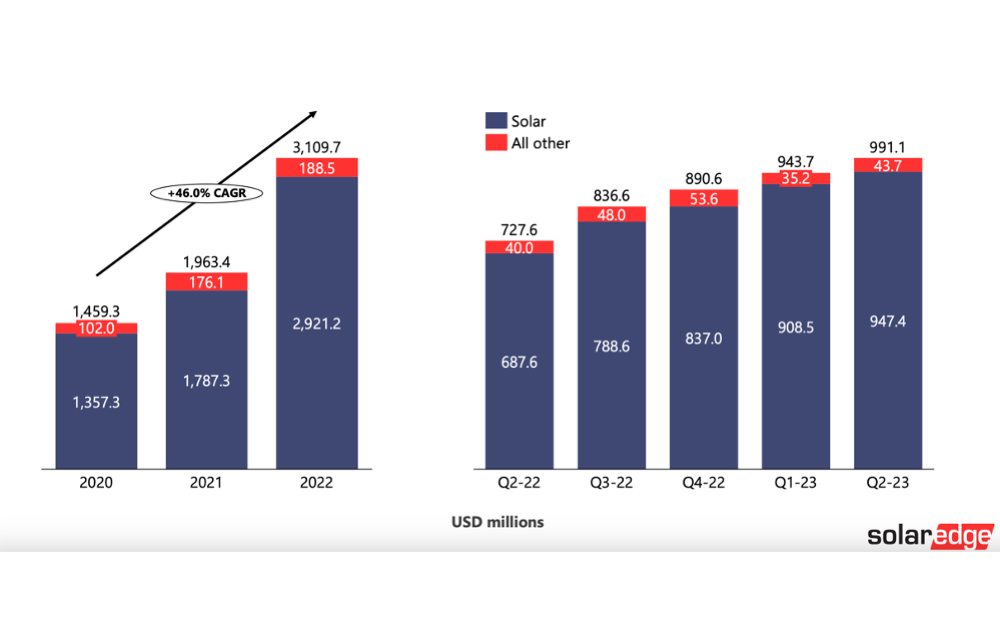

- SolarEdge’s Q2/2023 revenues of $991.3 million included $947.4 million from the solar segment

- The US market suffered with higher interest rates and NEM 3.0 in California as solar revenues dropped 23% QoQ

- Europe took 3.3 GW shipments of the total 4.3 GW inverters the company shipped during the quarter

- High inventory levels in markets as the US and Europe are impacting demand; inventory adjustment period expected to last next 2 quarters

Israel based SolarEdge Technologies reported record revenues of $991.3 million for Q2/2023, with its solar segment contributing $947.4 million, within the guided range. However, its US solar revenues dropped 23% QoQ and 37% YoY with higher interest rates and the new NEM 3.0 net metering regime in California. Europe offset the same with a 19% and 112% jump, respectively.

Higher interest rates in the US negatively impacted SolarEdge peer Enphase Energy’s business as well, as the latter announced recently (see US Market Pulls Down Enphase’s Q2/2023 Revenues). Even SunPower has blamed the same along with NEM 3.0 in California for its residential solar business not doing so well in the quarter (see SunPower Reports -$30 Million GAAP Net Loss).

Back to SolarEdge. The US represented 21% of the solar revenues for the quarter, taking in 666 MW in inverter shipments from the company. Europe, on the other hand, was the star performer for SolarEdge, procuring 3.3 GW during the quarter and accounting for 73% of the company’s solar revenues.

With 397 MW shipped to the rest of the world during the reporting quarter, SolarEdge’s total inverter shipments added up to 4.3 GW, including 2.6 GW of commercial and industrial (C&I) inverters. Other major markets for the company during this period were Germany, the UK, Switzerland, South Africa and Thailand. It also shipped 269 MWh of residential batteries.

Management pointed out that while supply chain pressures are easing on one hand, global solar market is now facing challenges related to higher interest rates and excess inventory.

As Europe currently has high solar module and inverter inventory, CEO Zvi Lando shared that distributors here are reducing the number of suppliers while also clearing piled up inventory. Similar phenomenon is being seen in the US where distributors built inventories anticipating demand, which did not materialize as expected. Inventory adjustments in these markets could take another 2 quarters.

Markets like South Africa and Thailand, facing grid instability and supportive regulatory environment, are growing rapidly.

US manufacturing plans continue to be on track, it added, for inverter shipments to begin in Q3/2023 (see SolarEdge Reports $837 Million Revenues In Q3/2022).

Revenues in Q3/2023 are guided to settle in the $880 million to $920 million range, non-GAAP gross margin within 28% to 31%, and operating income ranging between $115 million and $135 million. The solar segment is expected to contribute $850 million to $880 million to total revenues and gross margin of 30% to 33%.

Meanwhile, SolarEdge has also announced a joint venture (JV) with a Middle East and North Africa (MENA) region focused private sector company Ajlan & Bros Holding (ABH). The Riyadh, Saudi Arabia headquartered JV will supply SolarEdge’s renewable energy solutions for energy generation, storage and management to customers in the country. It will also provide modeling and energy transition consultancy.